Our Difference – Unlocking the Complexity Premia

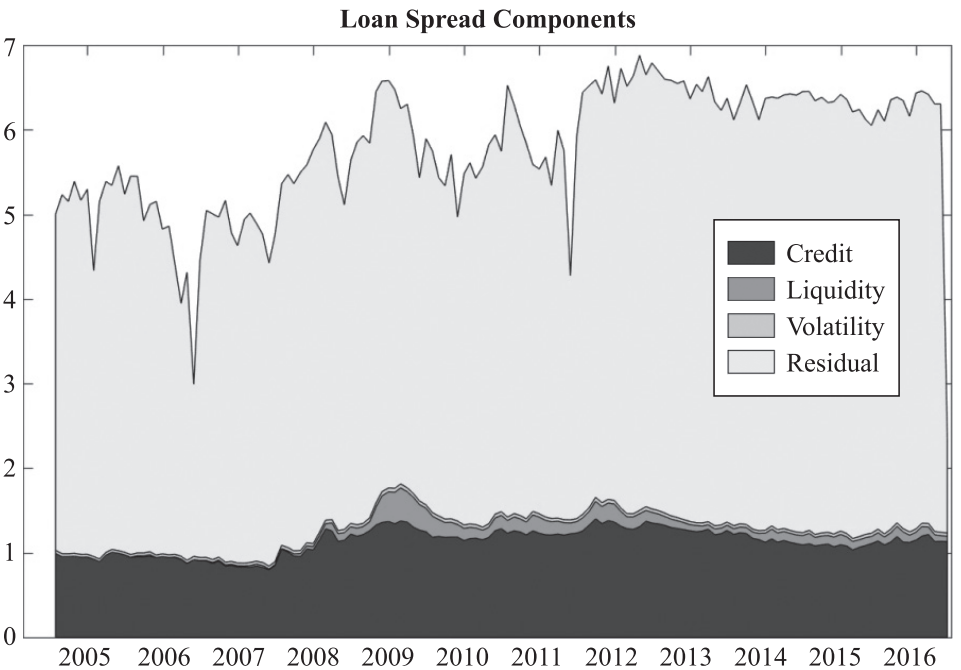

Our focus on complex assets and special situations requires a combination of unique sourcing, specialized skillsets, and deeper diligence, to uncover value and justify incremental returns. In private markets, these incremental returns, over and above the returns justified by credit, liquidity, and volatility risks1, are referred to as “Complexity Premia”. With our unique focus, we provide capital to opportunities which would otherwise go unfunded.

Simply put, Complexity Premium, refers to the additional return or compensation that investors may require for investing in complex financial instruments or strategies compared to simpler, more transparent investments. Complexity often adds layers of uncertainty, risk, and difficulty in understanding the underlying assets or mechanisms, which can lead to higher costs or lower liquidity for us. These risks may include:

Operational risk

Sourcing, managing and executing transactions involving complex assets and situations incur higher costs, including fees for specialized expertise, legal documentation, and operational complexities.

Informational risk

Understanding complex investments requires more extensive research and analysis, and there may be a lack of transparency or information may not be equally available to all participants, leading to information asymmetry.

Liquidity Risk

Complex investments often have limited liquidity, meaning they cannot be easily bought or sold in the market without impacting prices. Investors may demand a premium for holding illiquid assets to compensate for the potential difficulty in exiting their positions.

Regulatory risk

Complex investments may be subject to more stringent regulatory oversight or face greater uncertainty regarding future regulatory changes.

Structural risk

Complex investments may involve multiple parties or intricate contractual arrangements, increasing the risk of default or non-performance by counterparties.

More broadly, Margherita Giuzio et al, in their paper “The Components of Private Debt Performance”1 – … propose to think of such residual (spreads, unexplained by credit, volatility and liquidity risk) as a complexity premium, inherent to the loan instrument and to the private nature of the market.”.

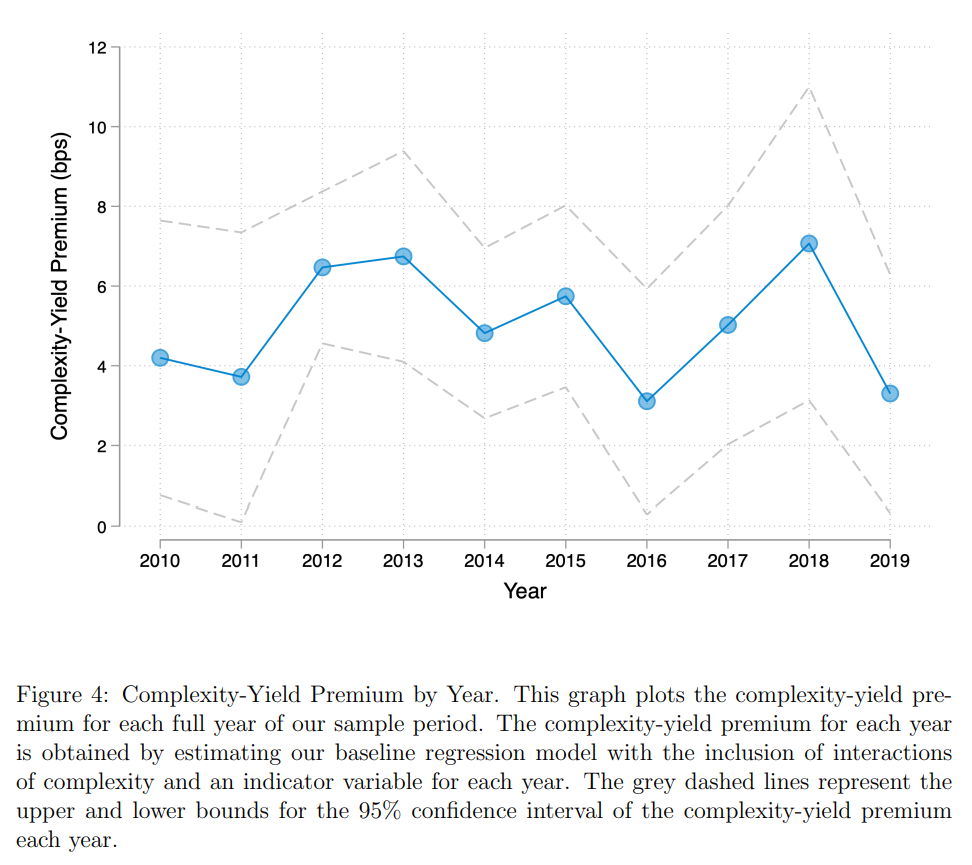

Michael Farrell et al, demonstrate a more specific example of Complexity Premium in the Muni markets in their research paper “The Complexity Yield Puzzle: A Textual Analysis of Municipal Bond Disclosures” 2 :

Overall, the complexity premium reflects the trade-off between the potential benefits and risks associated with complex instruments or strategies. We are willing and able to roll up our sleeves and navigate the complexities and uncertainties inherent in these investments to make capital available to our borrowers and sponsors.

Images: bvai.de · brookings.edu